Why Tether Still Sits At The Center Of Crypto Liquidity

Tether’s dollar token, USDT, remains the largest stablecoin in the world by a wide margin. Recent market data put its circulating supply close to 180–185 billion dollars, representing well over half of all stablecoin value and an even larger share of trading volume.

USDT is:

- The quote asset on many spot and derivatives markets.

- A settlement currency between exchanges and market‑makers.

- A core leg in numerous DeFi liquidity pools and lending markets.

That central role is exactly why traders get nervous whenever questions arise about its reserves or stability: a serious USDT problem would not be a niche issue, it would be a system‑wide shock.

The New Shock: S&P Cuts USDT To Its Weakest Stability Score

The latest wave of concern started when S&P Global Ratings updated its stability assessment on USDT.

In late November 2025, S&P lowered USDT’s ability to maintain its dollar peg from 4 (“constrained”) to 5 (“weak”) – the lowest score on its five‑point scale.

A news report and a more detailed analysis highlight several key reasons:

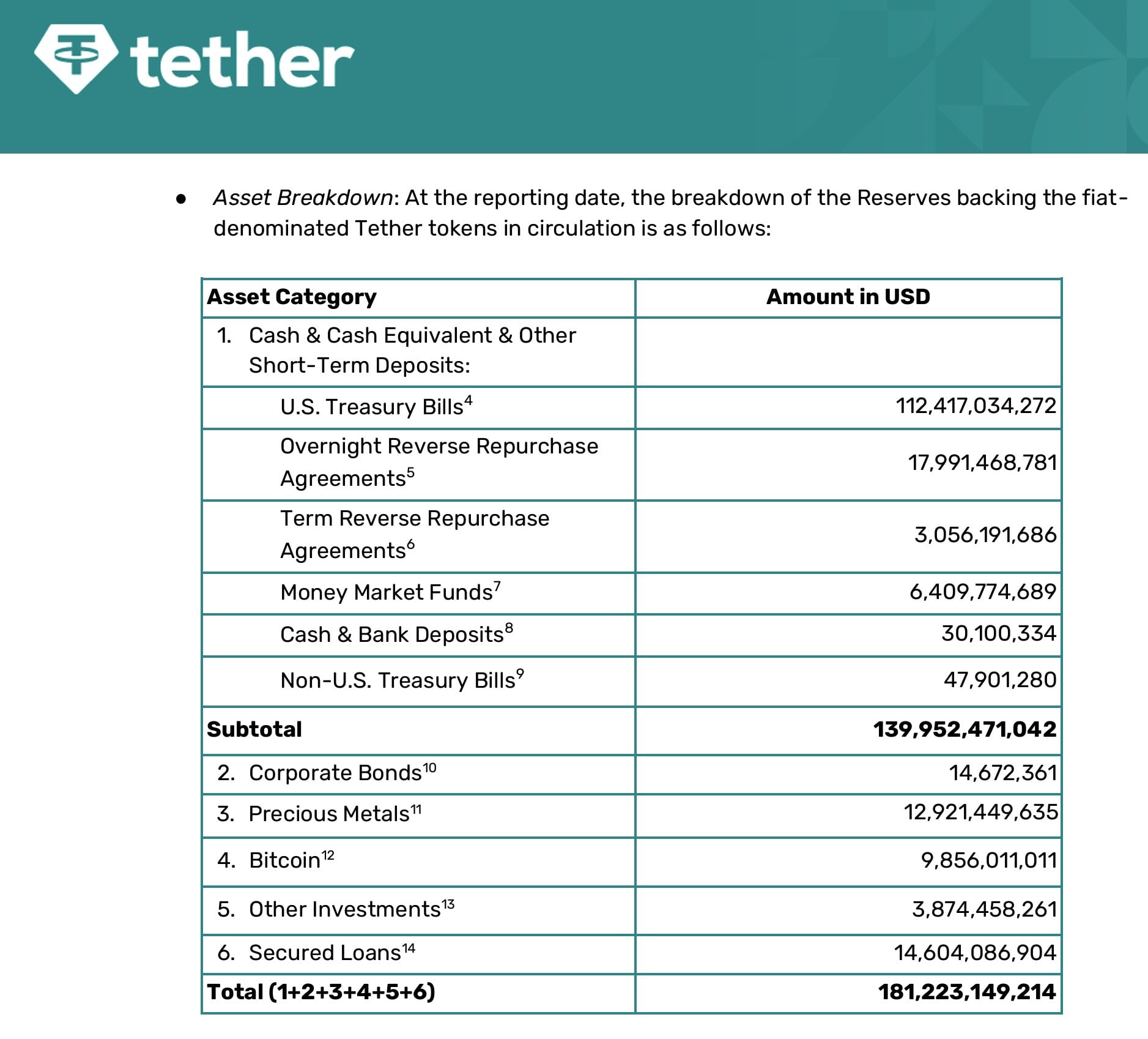

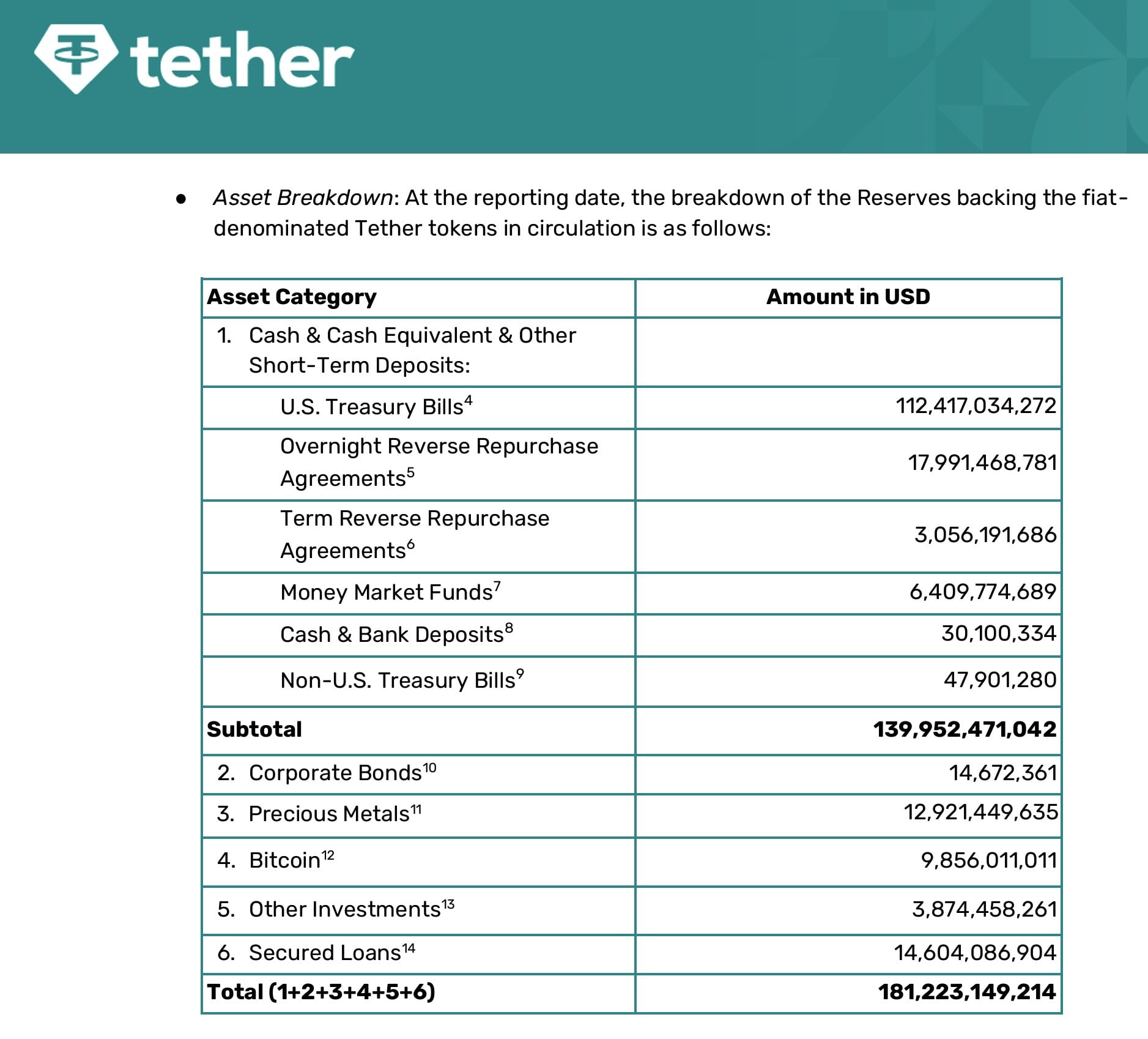

- Bigger share of high‑risk assets: Around 24 percent of Tether’s reserves now sit in higher‑risk holdings such as corporate bonds, secured loans, precious metals and Bitcoin, up from about 17 percent a year earlier.

- Thin overcollateralisation: S&P cites figures of roughly 181–185 billion dollars in reserves backing 174–184 billion dollars of USDT, implying only a few percentage points of equity cushion.

- Transparency gaps: The rating notes the lack of full audits, limited disclosure on custodians and counterparties, and unclear rules on how assets would be treated in a default or enforcement scenario.

A separate commentary underlines that Bitcoin alone now makes up several percent of reserves – more than the overcollateralization margin – which means a large drawdown in volatile holdings could, on paper, erase most of the buffer.

S&P also stresses that USDT has remained close to its peg through past bouts of volatility. The downgrade is less about recent price behaviour and more about how the reserve mix and disclosures have evolved.

Arthur Hayes’ “Thin Ice” Thesis

At almost the same time, Arthur Hayes – co‑founder and former CEO of BitMEX – published a blog and X thread that went viral in crypto circles.

Drawing on Tether’s latest attestation, Hayes argues that the company is no longer running a simple “cash and T‑bills” book but has effectively turned its balance sheet into a macro trade.

- Tether has accumulated tens of billions of dollars in Bitcoin and gold inside the reserve pool that backs USDT – roughly 34 billion dollars by some estimates.

- Its disclosed equity buffer is only a few percent of total reserves.

- A 30 percent drop in the value of those volatile holdings could, in Hayes’ view, wipe out most or all of that equity and leave USDT “theoretically insolvent” unless offset by other assets.

He frames Tether’s strategy as a bet that future Federal Reserve rate cuts will hurt interest income on Treasuries but send Bitcoin and gold higher. If that bet works, Tether’s profits and equity grow. If it fails, the reserve cushion shrinks.

Hayes is not claiming that Tether is currently bankrupt. His point is that a structure of this size, with this much embedded market risk, is sitting on “thin ice” if conditions turn.

Paolo Ardoino’s Response: “We Wear Your Loathing With Pride”

Tether’s CEO Paolo Ardoino has pushed back hard against both the S&P downgrade and the alarmed interpretations of Hayes’ analysis.

In a post on X that has been widely quoted, Ardoino wrote that Tether would “wear [S&P’s] loathing with pride” and argued that traditional rating models had steered investors into supposedly safe institutions and assets that later collapsed.

It highlights several counterpoints:

- Tether has earned more than 10 billion dollars in profits from its Treasury and other holdings and continues to add to its equity.

- USDT has held its peg through multiple crypto crashes and banking scares.

- The company sees S&P’s move as a political and competitive gesture from an “old system” threatened by a profitable, non‑bank issuer.

How Other Analysts Read The Numbers

Not everyone agrees with Hayes’ worst‑case framing, even among critics of Tether.

An ex‑Citi analyst, cited in a rebuttal and a separate report, argues that:

- The reserve disclosures are designed to mirror USDT liabilities, not to show Tether’s entire corporate balance sheet.

- Tether likely holds additional equity and operating assets outside the reserve portfolio, which Hayes’ simple ratio analysis does not include.

- From this perspective, Tether could absorb larger losses on its volatile holdings without becoming insolvent at the group level.

However, even these more optimistic takes concede that:

- Tether still publishes attestations, not full audits.

- Public information about custodians, segregation and rehypothecation remains limited.

- A large slice of reserves sitting in assets with market and credit risk is unusual for what many users perceive as a cash‑equivalent token.

Market Reaction: Peg Intact, Nerves Elevated

So far, USDT itself has remained stable. Price data from major exchanges show trading tightly around one dollar, with only very small intraday deviations. Arbitrage desks continue to swap USDT against dollars or other stablecoins when minor gaps appear.

Nonetheless, the headlines have had visible effects around the edges:

- Volatility in majors: Bitcoin’s recent intraday dump from above 91,000 dollars to below 88,000 in part to renewed chatter about Tether following the S&P downgrade and online debates.

- Perception gap vs USDC: Earlier S&P assessments gave Circle’s USDC much stronger scores. A stability comparison points out that USDC previously received a “2” (strong) stability score and “1” (very strong) asset‑quality grade, versus USDT’s new “5” (weak) rating.

- Focus on liquidity risk: While Tether appears solvent on paper, a sudden wave of redemptions combined with a sharp drop in Bitcoin and gold could create severe liquidity stress if large chunks of reserves had to be sold quickly.

In other words, the peg is holding, but the risk narrative around USDT has clearly shifted.

Why The Downgrade Matters Even If Nothing Breaks Today

S&P’s assessment is an opinion, not a regulatory order. It does not force exchanges or funds to stop using USDT. Yet it still matters for several reasons:

- Institutional risk limits: Many banks, brokers and funds rely on external ratings when setting internal limits. A move from “constrained” to “weak” can prompt risk committees to review, cap or reduce USDT exposure.

- Competitive positioning among stablecoins: A clear ratings gap between USDT and rivals like USDC can accelerate the trend of some institutions choosing alternatives for longer‑term holdings while still using USDT for high‑velocity trading.

- Regulatory pressure for transparency: The downgrade explicitly cites disclosure gaps. That gives regulators more ammunition to demand fuller audits, clearer rules on eligible assets, and stricter oversight of how reserves are custodied and segregated.

Even if USDT continues to function smoothly, these shifts can change how liquidity is structured across the market over the next few years.

Scenario Map: What Traders Actually Fear

Behind the social‑media noise, most professional traders are not betting on an immediate Tether collapse. They are weighing a few broad scenarios.

Scenario 1: Managed Risk, No Major Break

Tether continues to generate large profits on its Treasury portfolio, keeps a modest equity buffer and gradually leans reserves back toward safer assets under regulatory and market pressure.

USDT maintains its peg through occasional stress, and the main change is a slow rebalancing of long‑term holdings toward other stablecoins at the margin.

Scenario 2: Sharp Depeg, Fast Re‑Peg

A sudden risk‑off event or wave of redemptions pushes USDT materially below one dollar on major venues. Arbitrageurs buy discounted USDT and redeem it at par; Tether sells a slice of its liquid reserves to meet outflows.

The peg is restored, but the episode leaves scars: tighter rules, bigger risk premiums and a faster shift toward alternatives for savings‑type use cases.

Scenario 3: Structural Problem And Lasting Damage

This is the tail risk that fuels the most anxious commentary.

In this path, either a large undisclosed loss comes to light or a combination of asset‑price moves and legal constraints makes it impossible for Tether to honour redemptions fully. USDT trades at a persistent discount, redemptions are gated or halted, and regulators intervene.

The result would be a severe liquidity shock across crypto, forced deleveraging and a likely redesign of stablecoin rules worldwide.

Conclusion

Crypto traders are suddenly worried about Tether not because USDT has already failed, but because new information has sharpened questions about how thin its visible buffer is relative to its growing bets on volatile assets.

An S&P downgrade to “weak”, detailed reserve breakdowns showing tens of billions of dollars in Bitcoin and gold, and high‑profile warnings from Arthur Hayes have all highlighted the downside of running a giant stablecoin with a riskier reserve mix.

Paolo Ardoino’s response – dismissing S&P’s model, stressing profits and overcapitalisation, and saying Tether will “wear [traditional finance’s] loathing with pride” – shows that the company is not backing away from its confrontational stance.

For traders and institutions, the most realistic approach is neither blind trust nor constant panic. USDT remains a crucial piece of crypto plumbing that currently works, but it is also a non‑trivial source of systemic risk. Its reserves, disclosures and regulatory treatment will stay under a microscope until the structure either proves itself through future crises or is reshaped by market and policy pressure.